“F!X TH!S N0W!” — Simulation Warns Five Biggest Tourism Markets May Abandon U.S., Prompting Trump’s Furious Reaction

In an era where tourism is one of the most resilient economic sectors, a recent simulation and multiple travel industry forecasts have painted a worrying picture for the United States. According to several travel and economic reports, the U.S.

risks losing major tourism markets — including Canada, Mexico, the United Kingdom, Germany, and Western Europe — due to political tensions, restrictive policies, and negative international perceptions under the current administration.

This trend has caused alarm among industry leaders and prompted an intense reaction from former President Donald Trump, who has reportedly criticized the findings and urged urgent policy revisions.

Tourism: A Major Pillar of the U.S. Economy

International tourism has historically been a cornerstone of the American economy. In 2024, tens of millions of foreign visitors traveled to U.S. cities, theme parks, beaches, and national landmarks, contributing hundreds of billions of dollars in spending and supporting millions of jobs.

Cities like New York, Orlando, Los Angeles, and Miami rely heavily on inbound visitors for revenue. However, projections for 2025 show a stark reversal of this long‑term growth.

According to a broad dataset collected in 2025, inbound tourism numbers are declining sharply from major markets.

The most recent statistics show that arrivals from Canada, the United Kingdom, Germany, Spain, South Korea, and Australia are falling year on year, contributing to an overall decrease in international visitors to the U.S. of around 11.6% compared with earlier expectations. Wikipedia

Five Tourism Markets at Risk 1. Canada — The Largest Tourism Source

Canada has traditionally been America’s largest source of international tourists. Canadians contributed over $20 billion in tourism spending in recent years, with millions crossing the border by air and land.

But political tensions — including a trade dispute and rising nationalistic sentiment — have led Canadians to cancel trips in significant numbers. Bookings for travel to U.S. destinations have plunged, with some data suggesting declines in the double digits for air and road travel.

This shift threatens key border states such as Florida, New York, and California, which have built economies around Canadian visitors’ retail, hospitality, and entertainment spending. Las Vegas Review-Journal

2. Mexico — A Growing But Eroding Market

Mexico is another major source market, contributing nearly 17 million visitors in pre‑pandemic years. Travel And Tour World

However, data from early 2025 suggests that Mexican arrivals have weakened due to stricter border controls and visa policies tied to social media history declarations, leading many Mexican travelers to reconsider or cancel their American vacations. Travel And Tour World

With strong cultural and economic ties between Mexico and the U.S., a sustained downturn in this market could have ripple effects across tourism sectors, from hotels to theme parks and local attractions.

3. United Kingdom — Visa and Cost Barriers

The United Kingdom has historically been one of Europe’s biggest contributors to U.S. inbound travel. But a combination of economic pressures, higher travel costs, and more restrictive visa expectations have contributed to a 17% drop in UK arrivals according to recent forecasts. Travel And Tour World

Travel agents in the UK are noticing that travelers are opting for European destinations such as Paris, Barcelona, and Lisbon — where budgets stretch further and entry is perceived as more welcoming.

4. Germany — Europe’s Cautionary Tale

Germany, once a steady and reliable market for U.S. tourism, is now showing signs of significant decline as well. Early 2025 figures show a notable reduction in German travelers, attributed to both high costs and heightened security procedures at U.S. entry points. Travel And Tour World

This trend mirrors broader European sentiment; many Western European travelers are reported to be favoring alternative locations like Canada, North Africa, and other parts of Asia, citing anxiety about U.S. border policies. SCMP

5. Western Europe More Broadly

Data from several travel industry sources indicate that Western European visitors overall declined sharply, with some tour groups reporting bookings down by 20‑25% compared with the previous year. belganewsagency.eu+1

From Belgium to Spain, tour operators are echoing similar concerns: travelers are hesitant to commit to U.S. vacations due to changing immigration rules, perceived xenophobia in travel advisories, and a sense that the United States is no longer as welcoming as it once was.

Economic Impacts: Billions in Losses?

The recession in international tourism is not a trivial matter. The cumulative effects could push U.S. tourism revenue down by billions of dollars in 2025, according to multiple industry projections.

A significant portion of this drop is tied directly to fewer flights, canceled hotel stays, and lower retail spending by foreign visitors.

In one analysis, international visitor spending could fall below earlier projections by $12.5 billion to more than $60 billion, depending on how sustained the downturn becomes. nationthailand

This squeeze doesn’t just impact big gateway cities — smaller communities that depend on overseas visitors for seasonal employment, attraction traffic, and service jobs are also feeling the strain.

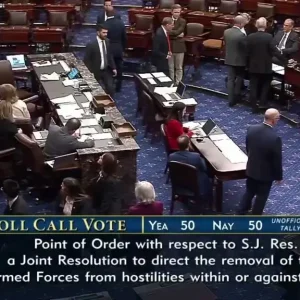

Trump’s Reaction: “F!X TH!S N0W!”

With the simulation and tourism forecasts circulating widely among industry leaders and policy analysts, former President Donald Trump has reportedly expressed strong displeasure and urgency regarding the situation.

According to insiders familiar with his comments, Trump has criticized the simulation’s findings and called for swift action to reverse the declining trend.

While detailed direct quotes from Trump regarding this specific simulation are not yet public, his broader stance on immigration and trade policies — often prioritizing security and sovereignty over open travel — suggests that any push for policy change will be politically charged and controversial.

In public and private discussions, Trump has urged policymakers to consider measures that would make the U.S. a more attractive destination again, including reviewing visa policies, easing certain travel restrictions, and engaging more strongly with allied nations.

What’s Next for U.S. Tourism?

The tourism landscape in 2026 and beyond will depend on a mix of political decisions, global perceptions, and travel behavior. If the U.S.

government — whether under Trump’s influence or other leadership — can address concerns about border procedures, welcome policies, and ease of travel, it may be possible to restore confidence among international tourists.

However, if current trends continue, the United States risks losing its competitive edge as a global tourism leader. Countries like Canada, Mexico, and major European markets could pivot permanently away from American vacations, favoring destinations that feel safer, more affordable, and more open.