A newly released Minnesota Office of the Legislative Auditor (OLA) report has sent shockwaves through state government, revealing a disturbing pattern of systemic failures, fabricated records, and alleged cover-ups within the Minnesota Department of Human Services (DHS). The findings confirm long-standing concerns that lax oversight and internal misconduct enabled massive fraud involving taxpayer-funded grants, raising urgent questions about accountability, governance, and public trust.

This report is already being described as one of the most damaging audits of a Minnesota state agency in recent history.

What the Minnesota Auditor Found

According to the auditor’s findings, the Minnesota Department of Human Services failed at multiple fundamental responsibilities, including:

Fabricating or backdating official recordsFailing to verify grant recipients’ eligibilityIgnoring clear warning signs of fraudAttempting to conceal internal failures once scrutiny began

The report paints a picture of an agency that did not merely make mistakes, but repeatedly violated basic internal controls, allowing fraudulent actors to exploit state programs for years.

At the center of the scandal is DHS’s administration of grant programs meant to support vulnerable populations—funds that instead were allegedly diverted through fraudulent organizations with little to no oversight.

Fabricated Records and Missing Documentation

One of the most alarming findings in the auditor report is evidence that DHS staff created or altered records after the fact in an apparent attempt to justify improper grant approvals.

Auditors documented instances where:

Required documentation was missing at the time grants were approvedInternal approval forms were created retroactivelyFiles lacked signatures, dates, or verification evidenceGrant decisions could not be traced to legitimate review processes

Such practices undermine the integrity of public administration and raise serious concerns about potential obstruction or misrepresentation during oversight reviews.

Failure to Verify Grant Recipients

Equally troubling is the auditor’s conclusion that DHS failed to properly vet organizations receiving millions of dollars in public funds.

In many cases, DHS did not:

Verify nonprofit status or operational capacityConfirm prior experience or financial stabilityEnsure compliance with grant requirementsConduct meaningful background checks

As a result, unqualified or fraudulent entities were allowed to receive substantial funding, sometimes repeatedly, despite obvious red flags.

Auditors noted that DHS often relied on self-reported information, a practice that significantly increased the risk of abuse.

Warning Signs Ignored for Years

The report confirms that DHS leadership and staff received multiple warnings that fraud was occurring but failed to take corrective action.

These warnings included:

Internal staff concernsInconsistent financial reports from granteesUnusual spending patternsLack of deliverables tied to grant funding

Instead of pausing payments or launching investigations, DHS frequently continued approving funds, allowing losses to grow exponentially.

Auditors concluded that DHS did not act with the urgency or diligence expected of an agency entrusted with billions in taxpayer dollars.

Alleged Efforts to Cover Up Internal Failures

Perhaps the most explosive aspect of the report is the finding that DHS attempted to cover its tracks once scrutiny increased.

The auditor identified behavior consistent with damage control rather than transparency, including:

Retroactive documentationInconsistent explanations to investigatorsShifting responsibility between departmentsResistance to external oversight

While the report stops short of assigning criminal intent, it clearly states that DHS actions compromised accountability and transparency, worsening the overall impact of the fraud.

Massive Fraud Enabled by Systemic Breakdown

The auditor emphasized that the fraud was not merely the result of bad actors outside government, but was enabled by DHS’s systemic breakdown in governance.

Key failures included:Lack of internal controlsPoor training of staffInadequate supervisionNo centralized tracking of grant performance

This environment created what auditors described as a “perfect storm” for fraud, where oversight was minimal and consequences were rare.

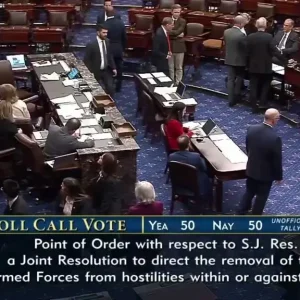

Political and Public Fallout

The release of the report has already triggered intense political reaction at the Minnesota Capitol. Lawmakers from both parties are calling for:

Legislative hearingsPersonnel accountabilityStructural reforms at DHSPotential criminal referrals

Public trust in the Department of Human Services—already strained by previous controversies—has taken another major hit.

Taxpayer advocates argue that vulnerable communities ultimately suffered the most, as funds intended for essential services were misused or stolen.

What Happens Next?

In response to the report, state officials are under pressure to act swiftly. Possible next steps include:

Independent investigationsLeadership changes at DHSTighter grant verification requirementsEnhanced auditing and compliance mechanisms

The auditor has issued multiple recommendations aimed at preventing future abuse, including mandatory documentation standards, independent grant reviews, and real-time monitoring of expenditures.

Whether these reforms will be implemented—and enforced—remains an open question.

Why This Report Matters

This bombshell Minnesota auditor report matters because it exposes how government failure can enable large-scale fraud, even in programs designed to help the most vulnerable.

It also serves as a warning to other states: without strong oversight, transparency, and accountability, good intentions are not enough to protect public funds.

For Minnesota taxpayers, the report is a stark reminder that government agencies must be held to the same standards they impose on others.

Conclusion

The Minnesota auditor’s findings confirm what many suspected but few could prove: the Minnesota Department of Human Services fabricated records, failed to verify grant recipients, ignored warning signs, and attempted to conceal its failures, all while massive fraud flourished.

As investigations continue and political pressure mounts, one thing is clear—this scandal is far from over. The coming months will determine whether Minnesota confronts these failures head-on or allows them to fade without meaningful accountability.

For now, the auditor report stands as a damning indictment of systemic dysfunction—and a critical test of the state’s commitment to transparency and reform.